Taking Stock

Once again, we’ve clicked over into a new Financial Year. Predictably, this is the time when Sydney’s property market slows down while buyers defer decisions until after the tax bill has been delivered.

In the twenty-five years since Rosalie and I first started our business, we’ve learned to use this opportunity to reflect and forecast.

The word that best describes Sydney’s market for the first quarter of 2017 is ‘stratospheric’. Auction clearance rates through February and March climbed above 80% – and remained there, comfortably, for Q1.

In such an atmosphere, it would have been easy to miss the dark clouds of May, when the auction clearance rates began to creak under the strain and dipped down to more sobering figures in the seventy percentile, before contracting even further to mid-sixties in June.

The reasons for these diminishing figures were many and varied, but our analysis pinpoints the following events as the triggers for the Sydney market.

Banks put the brakes on Investors

The Australian Prudential Regulation Authority (APRA) was determined to see a slowdown in investor growth in the second half of 2017 – a stance that the APRA Chairman, Wayne Byres, was quite blunt about at the time.

Consequently, the bank lending criteria for investors changed in May, requiring a loan-to-value ratio of 80% and effectively bringing to a close the days when an investor could buy property with a 5% deposit.

We believe this was the first and most important factor in easing the Sydney property market.

“Mr Byres’ speech claimed banks and other lenders claimed to have above-average practices, but an APRA survey found that some lenders were underestimating mortgage applicants’ expenses and sometimes lacking common sense when lending to investors.”

Changes to Stamp Duty

At the beginning of June, the NSW Government announced some welcome news for first home buyers.

Despite warnings from Reserve Bank Governor, Glenn Stevens, against ‘self-defeating’ subsidies that inflate house prices, the State Government announced its intention to scrap duty on existing homes up to $650,000 and further discounts on homes up to $800,000.

These changes represent savings of up to $25,000 for first home buyers – a significant section of the market feeding demand for properties in higher price brackets.

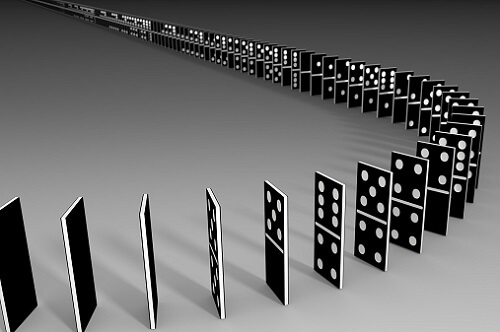

Notably, these changes did not come into place until July 1st 2017, effectively halting any prospect of first homebuyers in that price range purchasing a property until the new Financial Year. This domino effect continued through the higher market price brackets and and left the market in suspended animation – little wonder clearance rates tumbled!

Where to from here?

We anticipate clearance rates rising moderately. Seasoned agents will adapt to shifting market conditions and can be expected to achieve better results than less experienced counterparts, primarily because our focus is on prevailing market conditions and not on selling blue sky scenarios.

Rosalie and I believe that the new Stamp Duty savings for existing home owners will be a great help to offset the downturn in investors due to stricter lending criteria.

Finally, looking to Spring, we are optimistic that the market will return to buoyant levels and that there are great opportunities for both buyers and sellers ahead.